COVID and AI have certainly served up their share of surprises in recent years, triggering a wide range of reactions. But there is one thing that really has all of us on the same page: INFLATION. Recently, The price of everything has dramatically increased: food, gas, houses, education; even avocados feel like an investment. To combat this, the popular financial advice is to increase your salary or cut back on spending (as if we hadn't thought of that ourselves!). But there's another solution gaining popularity: relocation. Imagine swapping the cold streets of the North for a serene morning on a beach. What changes would your wallet notice before you do? That's the question we're answering in today's issue of Diaspora Dollars. In this article, we're going to explore a surprising comparison: the cost of living in a city in Africa versus a city in Canada, and how it can impact your financial journey. By comparing the cost of living in Djibouti and Ottawa, we'll give you a better understanding of how far your money can go in different parts of the world, and how this might help you reach your financial goals faster.

Before advancing to the comparison, it's worth keeping in mind the significance of striving for financial independence (FI) and why it's advantageous to do so in Africa:

Consider why you work. Many of us trade much of our time for money; thus, a significant portion of our life is dedicated to working to fulfill our needs and desires. FI provides the liberty to determine how you spend your time. Achieving FI in Africa can lead to an unparalleled work-life balance. Services are more accessible and affordable than in many Western countries.

Indeed, achieving FI in Africa doesn't require the exorbitant sums it does in many Western countries. For instance, Canadians say they need $1.7 million to retire. Whereas South Africans, for example, need R2,880,000 (equivalent to 149,328 USD). This is the case in various regions of Africa: your money can stretch further and buy more, affording you amenities that may be more costly elsewhere. These include security, house help, and personal chefs, among others.

Every year, Mercer, a global consulting firm, conducts comprehensive cost of living surveys in 207 cities worldwide. These surveys assess over 200 goods and services, providing a detailed picture of the cost of necessities like food, clothing, housing, and transportation. For our analysis, we've chosen to rely on Mercer's index as it caters to international employees who typically earn more than the average African citizen, making it an effective tool for comparing African cities with those in the G7. People in G7 countries, some of the richest in the world, typically earn around 47,000 USD annually.

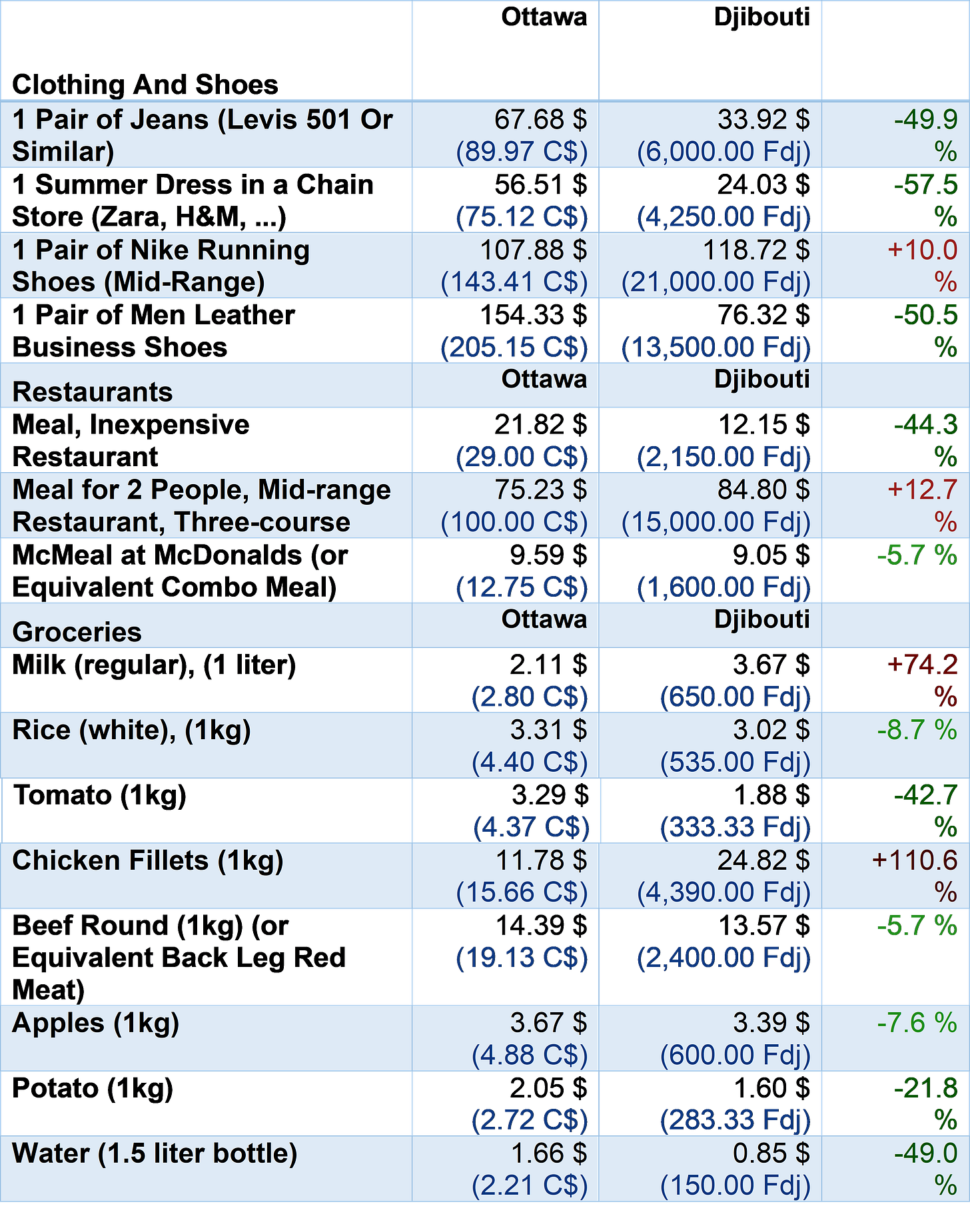

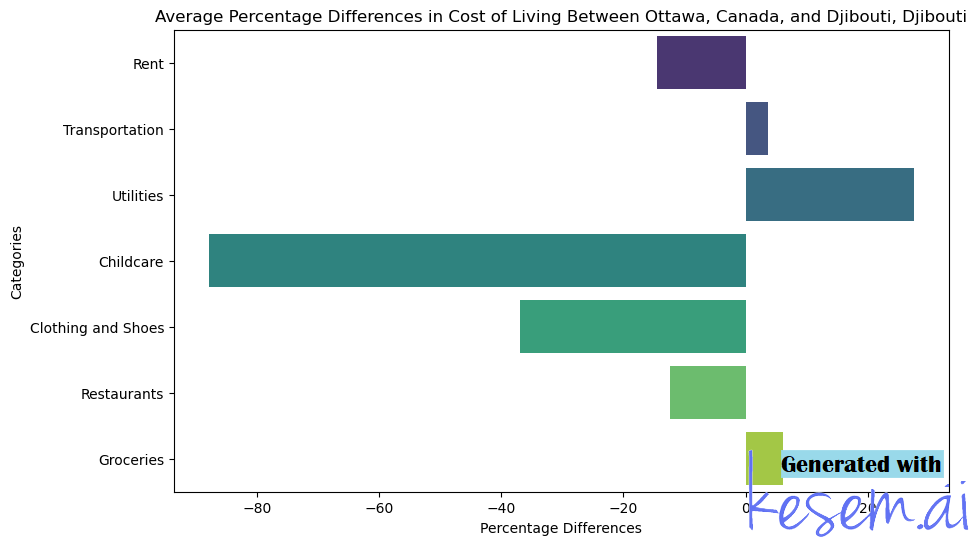

In this post, we compare the cost of living between Ottawa, Canada, and Djibouti, Djibouti. According to Mercer's Cost of Living Index, Ottawa has the lowest cost of living among G7 nations, while Djibouti is the second most expensive city in Africa. It's important to note that a high cost of living doesn't necessarily mean better living standards. For example, Bangui is ranked as the most expensive city in Africa, but its safety and habitability issues make it less desirable for relocation. Djibouti is the capital and largest city of Djibouti, while Ottawa is Canada's fourth-largest city and capital. We will use the G7 average annual income of 47,000 USD and data obtained from Numbeo to compare living expenses.

Per the chart above, residing in Djibouti is 16% less expensive compared to living in Ottawa. This 16% is cost savings that can have a tremendous impact on your income as it greatly contributes to your savings, which can help build a safety net or accelerate your retirement fund growth. Moreover, the extra income can open up more investment opportunities, leading to additional financial benefits. Alternatively, this additional income can elevate your lifestyle, allowing you to indulge in experiences that were previously unattainable. It is crucial to consider the substantial impact that residing in Djibouti can have on your financial stability and growth.

But the perks of Djibouti extend beyond monetary benefits. Strategically located at the crossroads of Africa, the Middle East, and Asia, Djibouti presents exciting business opportunities:

Real estate: Djibouti has a high demand for housing and commercial spaces due to its strategic location, population growth, and influx of foreign workers and investors.

Tourism: Djibouti offers a unique blend of natural and cultural attractions, such as beaches, volcanoes, coral reefs, whale sharks, historical sites, and diverse cuisines.

Logistics and warehousing: Djibouti is a key hub of global trade and transportation, connecting Africa, the Middle East, and Asia. It has a modern port, a free trade zone, and a railway link to Ethiopia. 15-20% of the world’s commercial ships transit here.

Moreover, Djibouti's natural beauty adds another layer to its appeal. Imagine living a stone's throw from serene, sandy beaches, where walking by the sea becomes part of your daily routine. Living here feels like a perpetual vacation, where the lines between work and leisure beautifully blur.

While this comparison covers a wide range of cost of living factors, it's not exhaustive. For instance, healthcare and taxes, which can significantly impact your cost of living, have not been included in this comparison due to a lack of sufficient data for Djibouti. Additionally, there may be other expenses unique to each city that hasn't been accounted for in this comparison. We hope this analysis gives you a good starting point and encourages you to do further research if you're considering relocating for financial independence.

When comparing the costs and benefits of living in Djibouti, Africa's second most expensive city, and Ottawa, the G7's most affordable city, it's important to keep in mind that numbers only provide a partial picture. Moving to a new city, particularly from a G7 city, requires careful consideration since each city has its distinct lifestyle, culture, and opportunities. It's always necessary to weigh the pros and cons. What works for one person may not work for another, so it's crucial to consider your personal goals, career prospects, and the type of lifestyle you desire. If financial independence is your aim, remember that there are many ways to achieve it, and living in a city with a lower cost of living is just one option. If you have any thoughts on this comparison or have lived in either city, please leave a comment below. I would appreciate any suggestions for future cost of living comparisons as well.

Resources: