A Tale of Two Cities: Nairobi - San Francisco

Change Is The Only Constant In Life - Heraclitus

Malik Djinadou

What if I told you that you could live a much more comfortable life without having to increase your salary? Imagine finding a city halfway across the world that offers a similar lifestyle to what you have now but at a fraction of the cost. Wouldn't you be tempted to pack your bags and start a new adventure?

That’s the situation many urban professionals face today. As part of our cost of living comparison series, we will explore whether relocating from San Francisco to Nairobi could ease financial burdens. Both cities have emerged as major tech hubs: San Francisco at the epicentre of Silicon Valley and Nairobi as Africa's Silicon Savannah. In this edition, we'll take a journey comparing the cost of living between Nairobi, a gem in East Africa, and San Francisco, the tech capital of the world. As you read this article, think about your situation and consider the possibilities. Could relocating be the key to achieving your financial goals and improving your quality of life? We'd love to hear your thoughts in the comments below. Our aim is to give you a clearer picture of where your dollar (or Kenyan shilling) might stretch further, and how a change in geography might be the change your wallet needs.

Note: This is Part One of a two-part comparison between Nairobi and San Francisco. This part focuses on general aspects such as cost of living and quality of life. Part Two will delve deeper into the tech scene, comparing the Silicon Valley space in both cities.

Nadia

Meet Nadia, a software engineer living in San Francisco. Like many tech professionals, she moved there for high salaries and career opportunities. But now in her early 30s, Nadia feels burnt out by the go-go Silicon Valley lifestyle. She's tired of spending hours commuting in traffic every day, having to fork over $4,000 a month for a tiny apartment, and missing out on nature confined to the urban sprawl.

Nadia dreams of having more work-life balance, financial flexibility, and adventure. She starts considering what it would take to move somewhere more affordable and enriching. While researching online, she discovered Nairobi, Kenya. Intrigued, Nadia dives into comparisons between the two cities.

She's amazed to learn Nairobi has become a major tech hub called Africa's Silicon Savannah, with companies like Microsoft and Google having a presence there. The prospect of still being able to pursue her tech career in Nairobi sounds promising. Plus, Nairobi would allow her easy access to wildlife safaris and natural beauty right in the city limits.

Looking at the numbers, Nadia is shocked to see consumer prices are, on average, 70% lower in Nairobi across the board. The average monthly rent for a 1-bedroom apartment is only around $400 compared to the staggering $3,274 she pays now in San Francisco. According to the data, grocery, dining out, and even things like haircuts are all far cheaper.

The idea of her salary stretching so much farther is definitely appealing. She could work remotely from Nairobi for a US company and likely save $50,000+ more each year without even receiving a raise. The prospect of reaching financial independence faster and gaining more freedom is hard to resist.

Of course, Nadia knows that relocating would require adjustments, too: while Nairobi offers modern conveniences and development, some infrastructure, like public transit, is still catching up to places like San Francisco. Power and water outages can happen periodically as well. But Nadia understands the tradeoffs and feels the lower cost of living and improved quality of life would make it worthwhile.

Nadia realizes this significant move requires more research and planning. But the more she explores the possibility of Nairobi, the more she can envision calling Africa her new home. She's excited by the thought that this international shift could be a game-changer for achieving her financial goals and living life to the fullest. What do you think of Nadia's realization? Could a similar move to an affordable city like Nairobi allow you to reach your version of financial freedom faster, too?

Some Numbers

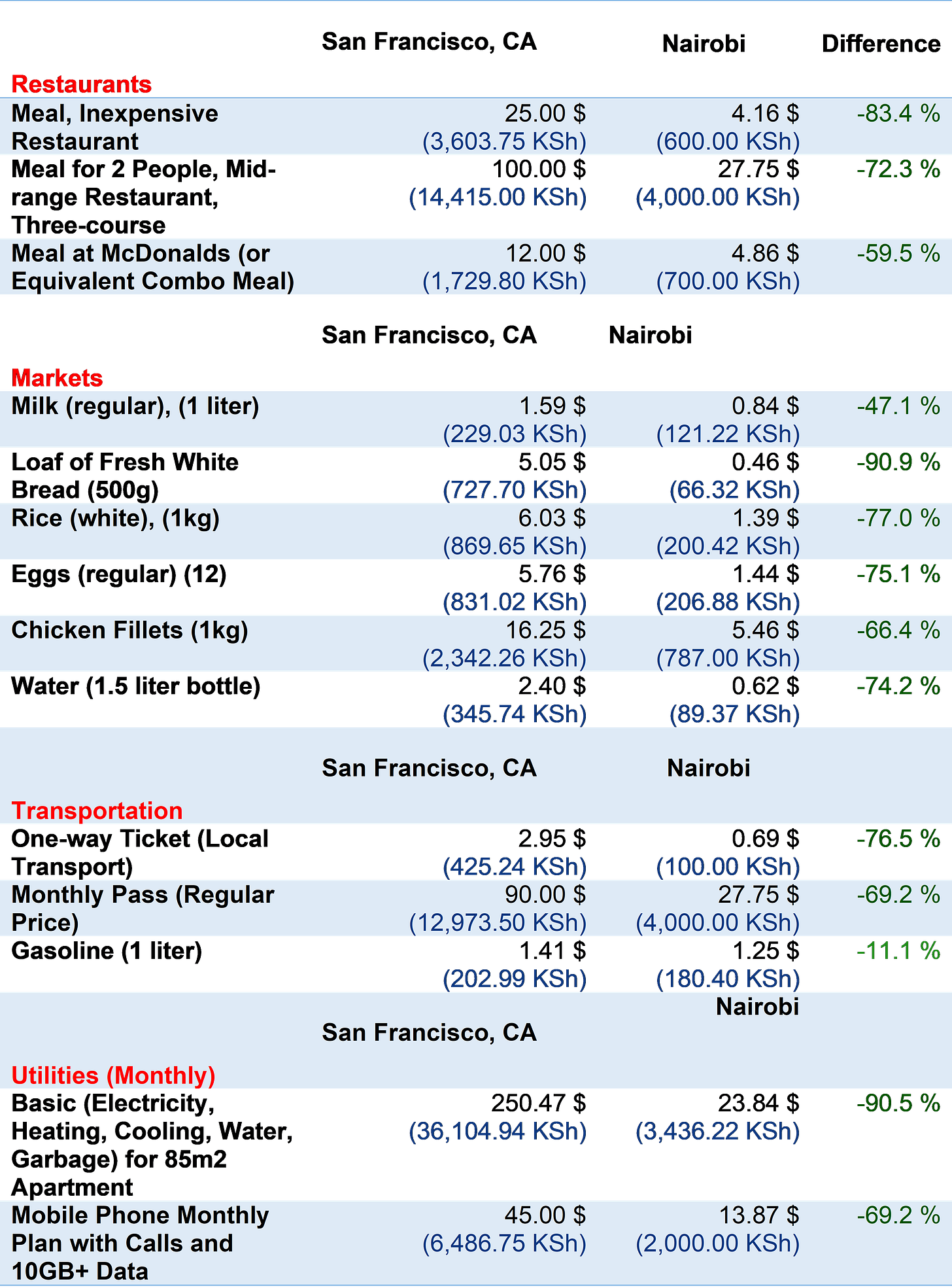

(Data from Numbeo)

Summary:

Consumer Prices in Nairobi are 68.8% lower than in San Francisco (without rent).

Consumer Prices in Nairobi are 78.1% lower than in San Francisco (including rent).

Rent Prices in Nairobi are 89.1% lower than in San Francisco.

Restaurant Prices in Nairobi are 74.9% lower than in San Francisco.

Grocery Prices in Nairobi are 71.5% lower than in San Francisco.

Health Care and Quality of Life

An essential aspect of choosing a city to live in is the quality of healthcare and its overall quality of life. Both Nairobi and San Francisco have relatively high healthcare indices, which measure the overall quality of the healthcare system, healthcare professionals, equipment, staff, doctors, and cost. The index ranges from 0 to 100, where 100 is the best possible. Nairobi has a healthcare index of 62.35, while San Francisco has a slightly higher one of 63.911.

However, the cost of healthcare is much higher in San Francisco than in Nairobi. For example, a short visit to a private doctor costs about $15.00 in Nairobi but about $200.00 in San Francisco. A monthly supply of medicine for chronic conditions costs approximately $30.00 in Nairobi but about $500.00 in San Francisco.

Moreover, the quality of life index, which measures the general well-being of individuals and societies, is slightly higher in San Francisco than in Nairobi. This index considers purchasing power, safety, health care, climate, cost of living, property price to income ratio, traffic commute time, pollution, etc. Nairobi has a quality of life index of 50.38, while San Francisco has a quality of life index of 53.81.

The significant price disparities between San Francisco and Nairobi can be attributed to several interconnected factors, such as economic development, supply and demand, infrastructure, government policies, and cultural norms.

San Francisco is situated in one of the most economically prosperous regions globally, resulting in higher wages and inflated costs for goods and services. Conversely, Nairobi is located in an underdeveloped region where expenses are generally lower.

Furthermore, San Francisco's robust economy, employment opportunities, and quality of life make it a highly desirable place to reside, creating high demand and limited housing and service availability, which drives up costs. Nairobi, on the other hand, although also an attractive location, does not face the same intense demand pressure.

Government policies such as taxes, subsidies, and regulations also play a role in determining the cost of living disparities. San Francisco has higher taxes and stricter regulations than Nairobi, resulting in increased costs.

The only certain things in life are death and

Taxes. Taxation is another factor impacting disposable income and cost of living. San Francisco has a complex and high tax burden, including a payroll tax on employee compensation that ranges from 0.38% to 1.5%, depending on business size and type. There is also a gross receipts tax on total revenue, regardless of profitability, as high as 0.65%. Hypothetically, a tech firm with $30 billion in sales and 10,000 local staff would pay 20 times more taxes in San Francisco than Mountain View.

In contrast, Nairobi takes a flat tax approach with fewer business levies which means that the tax rate is the same for all taxpayers, regardless of their income or profit. Firms pay a single annual business permit fee from KES 2,000 to 200,000 (USD 18 to 1,800), depending on size and sector. Additionally, a property rate tax of 25% of a property's annual rental value applies. However, Nairobi struggles with tax collection and expanding the tax base due to high informality, corruption, and weak enforcement.

While the lower taxes in Nairobi allow residents to keep more of their earnings, the reduced revenues also limit the city's ability to provide the same level of infrastructure and public services as San Francisco. But for those focused on maximizing take-home pay, Nairobi's tax structure is advantageous. The trade-off is weighing the quality of life factors enabled by tax revenues against individual income growth potential.

Kenya ≠ Safari

”My favourite part of my trip to Kenya was the lions at the safari.”

Kenya is more than just a safari destination. Sure, you can see the majestic lions and other wildlife at the Nairobi National Park, which is conveniently located near the city center. But don’t let that fool you into thinking that Kenya is all about nature and animals. Nairobi, Kenya's capital and largest city, is a vibrant and cosmopolitan metropolis that offers a wealth of opportunities for business, technology, culture, and entertainment. Known as the “Green City in the Sun,” Nairobi is a place where you can enjoy the best of both worlds: urban sophistication and natural beauty.

Opportunities

Kenya is not only a leading tourism destination in Africa but also a dynamic and diversified economy with many opportunities for growth and investment:

Agriculture: Kenya is a major producer and exporter of agricultural products, such as tea, coffee, flowers, fruits, and vegetables. It has a favourable climate, fertile soils, and abundant water resources. Agriculture contributes about 25% of Kenya's GDP and employs over 40% of its workforce.

Technology: Kenya is a regional leader in innovation and digital transformation, with a vibrant ecosystem of start-ups, incubators, and accelerators. It has a high mobile penetration rate, one of the world’s leading well-developed mobile money systems, and a supportive regulatory environment. Technology accounts for about 11% of Kenya's GDP and has created over 180,000 jobs.

Manufacturing: Kenya is a hub of industrial activity in East Africa, with a strong manufacturing base that includes textiles, leather, food, beverages, chemicals, plastics, and metal products. It has access to regional and international markets through preferential trade agreements and its strategic location. Kenya also has a modern port, a free trade zone, and a railway link to Ethiopia, which, by the way, is a landlocked country that relies on its neighbouring countries to facilitate trade and transportation. Other industries include oil refining, aluminum, steel, lead, cement, and commercial ship repair. Industry and manufacturing contributes about 14% of Kenya's GDP.

Is The Grass Always Greener?

Choosing between Nairobi and San Francisco isn't merely a decision between two cities; it's a choice between two distinct lifestyles, cultures, and economic scenarios. While Nairobi offers a more affordable cost of living with its own unique charms, San Francisco stands as a hub of innovation and opportunity, albeit with a heftier price tag. For those contemplating relocation, weighing the tangible financial implications against the intangible benefits each city offers is essential. After all, the true essence of a city goes beyond its price tags—it's about the experiences, opportunities, and memories one can create there.

Moving to a new city, particularly from a G7 city, requires careful consideration since each city has its distinct lifestyle, culture, and opportunities. It's always necessary to weigh the pros and cons. What works for one person may not work for another, so it's crucial to consider your personal goals, career prospects, and lifestyle you desire. If financial independence is your aim, remember that there are many ways to achieve it, and living in a city with a lower cost of living is just one option. Please comment below if you have any thoughts on this comparison or have lived in either city. Any suggestions for future cost of living comparisons would be greatly appreciated.

Stay tuned for Part Two of this comparison, where we will dive deeper into the tech scene in both Nairobi and San Francisco, exploring the dynamics of the Silicon Valley space in both cities.

Thank you Edwin, for your insight. Doing research on Kenya has really opened my eyes to the slew of possibilities beyond Nairobi as well. It really is an ideal place to live for anyone with a remote job!

You really hit the nail on the head. Nairobi is a tech hub for anyone intending to work remotely and take advantage of the geography arbitrage in terms of costs of living. For Nadia even a house worth $250 can make her live like a kingdom. Your comparison is on point. Even if she wants to live outside Nairobi, the cost of living be even lower by 50% and she will achieve financial independence in a half a year. Plus, she will have access to 4G and 5G network. I am not even in Nairobi, am in a remote town called Kericho, miles away from Nairobi, and I can access everything that I need as a tech-savvy.