Malik Djinadou

In the first installment of Common Cents, we delved into several African communal savings methods that showcase the continent's unique approach to financial collaboration. Rooted deeply in culture and community, these methods, including the West African Susus and Tontines, East African Chamas, North African Jam'iyyas, and South Africa's Stokvels, emphasize collective effort and mutual trust, often managed by respected community figures.

These practices have distinct advantages, notably the cultivation of social connections, peer motivation that fosters higher savings rates, adaptability to community needs, and accessibility to those often left out of formal financial systems. They also beautifully knit communities together beyond mere financial transactions. Yet, they come with their own set of challenges: the potential for limited financial growth, issues with scalability, and the inherent risks in trust-based systems.

As we transition into our second segment, we'll juxtapose these African traditions against Western savings paradigms, exploring how modern financial tools can complement age-old practices.

Modern Western Savings and Investment Practices

In countries like the USA and Canada, the primary savings methods are:

Banks and Credit Unions: These offer a variety of savings accounts, fixed deposits, and Certificates of Deposit (C.D.s) that pay interest to savers and are insured by the government up to a certain limit.

Retirement Accounts: 401(k) plans in the U.S. or RRSPs in Canada allow individuals to save for retirement while enjoying tax benefits. They can invest their contributions in various securities, such as stocks, bonds, or mutual funds.

Stock Markets: Individuals invest in stocks, bonds, and mutual funds through digital platforms or investment banks. They can earn dividends, interest, or capital gains from their investments but face market risks and fees.

Real Estate: Property investment is a popular way to build wealth by buying property directly or through Real Estate Investment Trusts (REITs). Real estate can provide rental income, tax advantages, and appreciation but also requires maintenance, management, and financing costs.

Mobile Banking: Modernizing Traditional Practices

A staggering 64% of adults in Sub-Saharan Africa don't have a bank account. This makes these traditional methods not just preferred but essential. Traditional African savings methods remain popular. However, mobile banking has become a transformative force in the financial landscape, especially in regions where many are unbanked or underbanked."

Enhancing Accessibility: Mobile banking apps allow users to participate in savings groups without the need for physical meetings. This is especially vital in remote areas where bank access can be challenging. In Africa, only 35% of the population has access to formal financial services, while 60% use mobile money. Mobile banking enables people to save, send, and receive money anytime and anywhere without travelling long distances or incurring high fees. As of 2020, there were 310 live mobile money services worldwide, and 55.2% were in Africa.

Formalizing Savings: Platforms like M-Pesa in Kenya or MTN Mobile Money in various African countries allow groups like Chamas or Tontines to manage contributions, distributions, and investments more transparently. These platforms provide digital records of transactions, which can help prevent disputes and enhance accountability among group members. They also allow groups to access a wider range of products, such as savings accounts, insurance, and stock market investments.

Safety and Security: With mobile banking, there’s less reliance on a single individual or group to hold and manage funds, reducing the risk of mismanagement or fraud. Mobile banking also protects users from theft, loss, or damage of cash, which can be a common occurrence in some areas. Moreover, mobile banking platforms use encryption and authentication mechanisms to ensure the security and privacy of users’ data and transactions.

Interest and Loan Benefits: Some mobile banking platforms now offer interest on stored amounts and allow users to secure micro-loans, enhancing the potential benefits of group savings. These services can help users grow their savings and access credit for various purposes, such as education, health care, or business expansion.

Integration with Modern Commerce: Making digital payments for different services such as groceries, utilities, and online shopping is much more convenient with mobile banking. With mobile banking platforms, users can easily make payments to various merchants, billers, and e-commerce platforms. This not only makes transactions more convenient but also promotes the transition from cash-based to digital economies, opening up new opportunities for businesses and entrepreneurs to expand their markets and reach more customers.

However, mobile banking is not without its challenges. Network issues, cybersecurity concerns, and resistance from older generations unfamiliar with digital tools can sometimes be hurdles. Yet, the growth trajectory indicates a promising evolution in how Africa saves, invests, and spends.

Bridging the Gap

With mobile banking's rise, Africa stands at the intersection between traditional communal saving and modern personal finance. Mobile tools now connect ROSCA members digitally to formal banking products. However, they also come with potential challenges:

Limited potential for financial growth: Given that the amount saved is often redistributed among participants, there's a cap on financial growth.

Scalability issues: As they often rely on face-to-face meetings and personal relationships, scaling them can be challenging.

Trust-based risks: Funds can be misused without a formalized system or oversight.

On the other hand, Western financial systems offer the potential for growth, investment diversity, and large-scale operations through vehicles like banks, stock markets and retirement funds. Yet, they can be perceived as impersonal and might not cater to the specific needs of every community.

Now, mobile tools are beginning to weave these worlds together. ROSCA members, for instance, can directly connect digitally while also being introduced to formal banking products.

Comparison

Imagine Sarah, a tech professional in Boston, and Amina, a teacher in Dar es Salaam. Sarah uses a digital app to invest spare change in the stock market. Meanwhile, Amina contributes to her local Chama. Market fluctuations influence Sarah’s investments, while Amina's savings grow based on community contributions.

Chama vs. Susu vs. Tontine vs. Gam'eya vs. Stokvel: At their core, all these systems are based on trust within a community. While the mechanics vary slightly, the objective remains: communal saving that provides members access to lump sums on a rotational basis or for specific needs.

Existence in the West: The concept of communal savings isn't mainstream in Western countries. However, there are similarities in informal savings clubs or investment clubs where members pool funds for a shared purpose. Moreover, African immigrants in these countries have continued these traditions in their social circles.

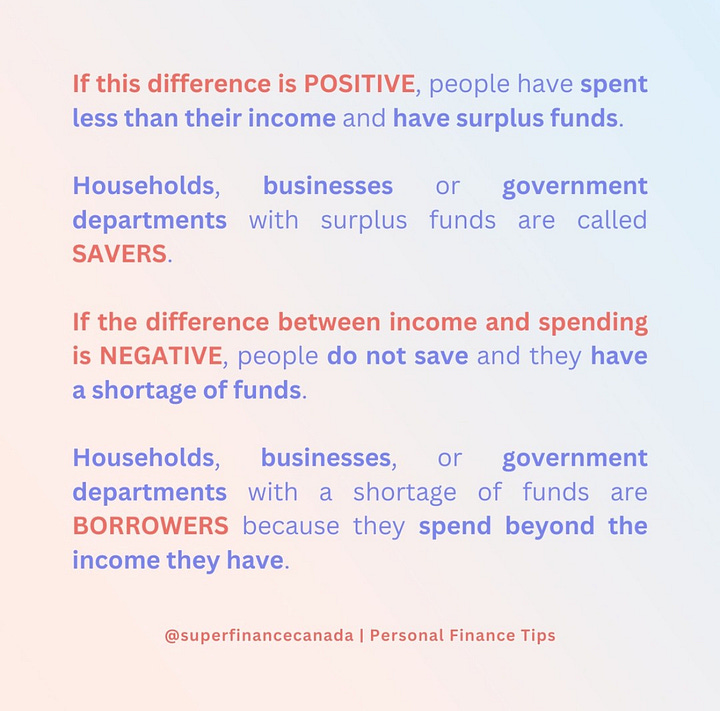

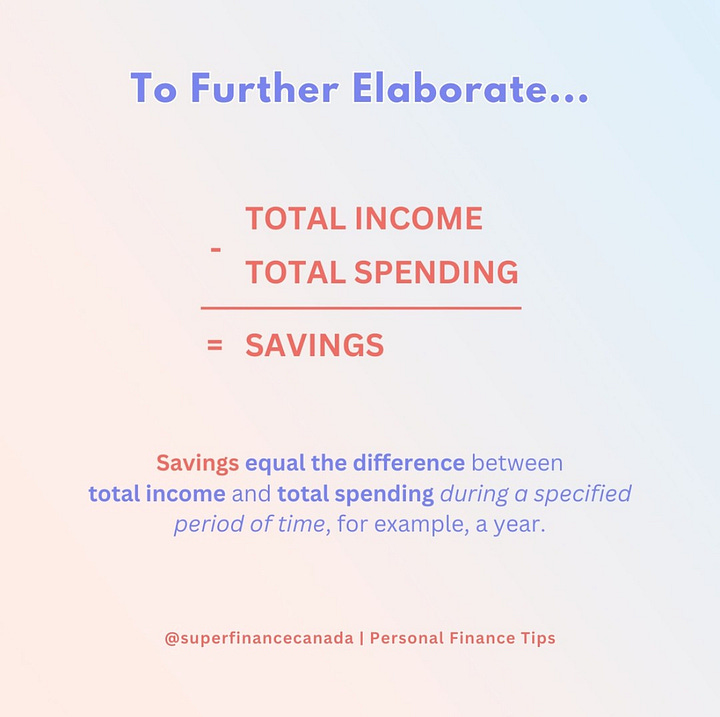

Saving and Borrowing: The West and Africa diverge regarding credit. In Western countries, individuals who fail to save can access funds by borrowing from savers. This creates the concept of creditworthiness, where debt is compounded with interest. Conversely, in most African countries, a lack of savings or contributions results in limited financial options. Both systems underscore the importance of savings, albeit in different ways. (The Western credit system is starting to spread in African countries.)

Why Saving Is Necessary

The Path Forward: A Hybrid Future?

Savings in Africa are more than just about money; they signify pooled dreams, hopes, and futures. A one-size-fits-all imposition of Western practices might disregard the nuances of traditional community dynamics. However, failing to leverage modern tools can also stunt growth and innovation.

The ideal future might lie in a hybrid system honouring Africa's rich savings heritage yet connecting its people to the broader digital economy. By merging traditional trust-based methods with modern technological efficiencies, we can broaden access and bring about innovations in finance.

Navigating this path won't be without its challenges, but the potential payoff — a financial system that truly marries communal support with individual aspirations — could be groundbreaking. It beckons a future where we save together yet dream big.