Welcome back to another installment of the Diaspora Dollars Principles (DDP) series, where we examine personal finance principles and fit them in the African context.

The previous DDP post discussed how success is a lagging indicator—essentially, your past behaviour and thinking reflect your current reality.

Today's principle focuses on a crucial aspect of success: seeking advice from successful people. Typically, when we aim to improve ourselves, we look up to our mentors or role models and try to emulate what they do to attain similar success. However, today, I want to share an exception to this rule.

For example, when I started to take weightlifting seriously, I had a regimented workout program. Every day, I worked on different body parts, focusing on progressive overload and varying intensities.

Today, I take a more minimalistic approach: I work out three times a week (at best) And typically do the same exercises every week.

I have pretty much achieved most of what I wanted to achieve when I started working out, and I am pretty content with how I feel and look. Thus, I exercise pretty much because I enjoy it and because of its benefits.

So, on my path to becoming a personal trainer, when I was asked for advice, I would respond with my minimalistic protocol: you need to work out 2-3x a week consistently for an extended period of time, and you will achieve your goals. However, this advice didn’t always work for beginners (depending on their goals). Although it is not bad advice (it’s actually great advice tbh), these were not the guidelines I followed when I started out. To get to where I’m at, I had to commit a lot of TIME. I trained nearly every day. I ate as much as possible. I tried out bodybuilding exercises. Powerlifting. Calisthenics. I took time to build up habits, strength, accountability, and discipline. I failed. A LOT. The point is that a lot of hard work was done, which enabled me to take a more comfortable approach today. So, I learned that to get people to achieve their goals in the gym, I had to reevaluate my advice and see what worked for me when I was a beginner so that I could help someone starting out as well.

Switching back to the MONEY

Another example would be the millionaire: today, most millionaires do not look at how much they spend on things like food. Most financial advice will tell you to spend and think like a millionaire. But if you aren’t a millionaire and live paycheck to paycheck, not budgeting your food spending will deter you from becoming a millionaire.

This is why we should sometimes beware of the advice of the successful. The personal trainer or the millionaire (i.e., the mentor) may overlook the initial steps and struggles crucial to their early progress.

That being said, yes, you should generally follow and listen to the advice of people who are in a position that you want to be in; however, be aware of the nuance that sometimes their behaviours and modes of thinking are not the same behaviours and modes of thinking that they employed to get them to where they are.

How Does Africa Play Into This?

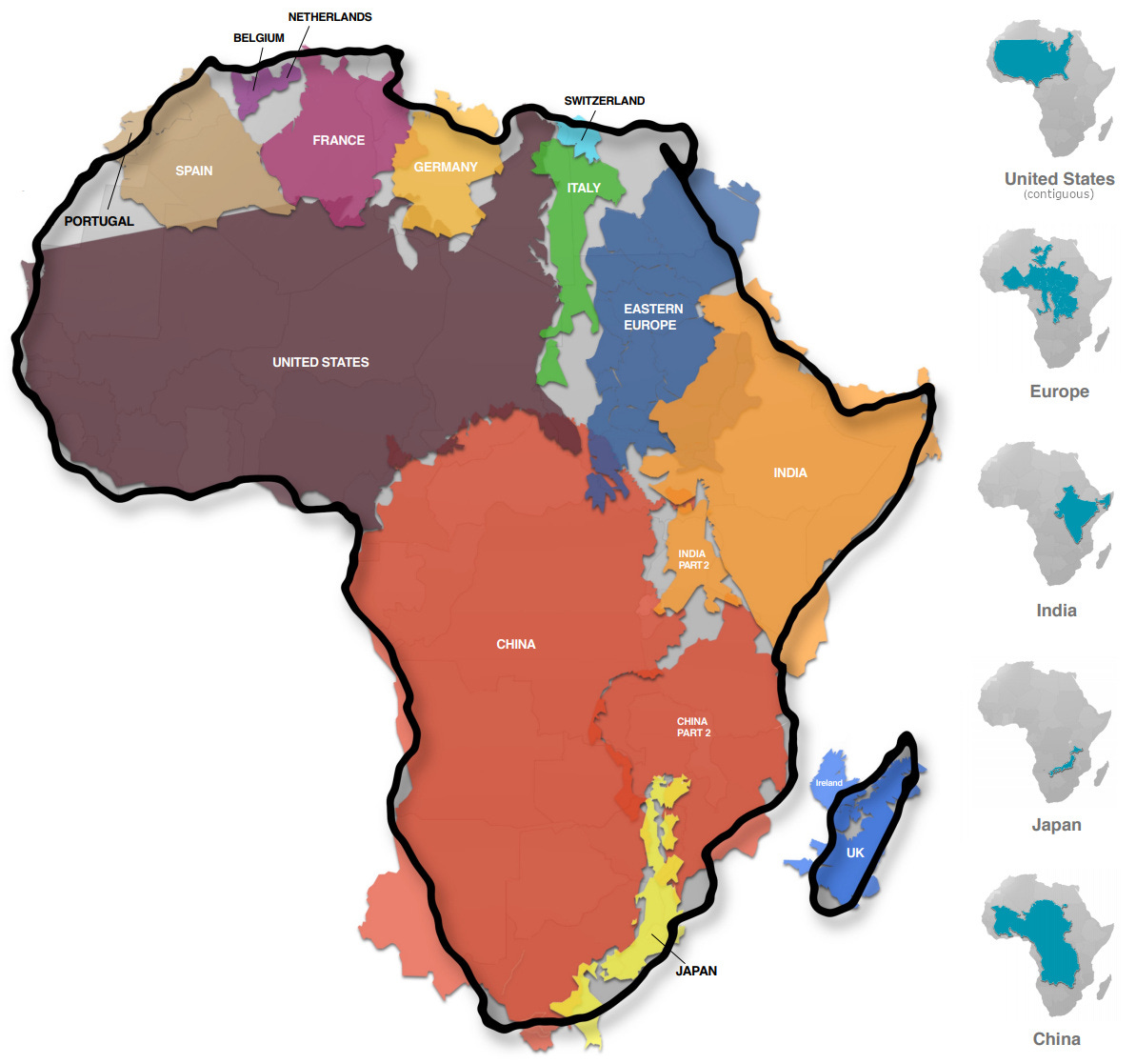

Africa needs to understand this: we won’t become China, The U.S., or Europe by doing what they are doing now. we have to look at what they did in the past as they were coming up to become global superpowers: They put a large segment of their population in productive labour that contributed to a sustainable economy. They consolidated their states. They invested in education tailored to their environment and culture. They pushed innovation through high spending on research and development (R&D). And they fostered entrepreneurship and a free market. These are all things Africa is struggling with currently: most of our economies are engaged in unproductive labour. This is partly attributed to an education system that is not designed BY and FOR Africans and their immediate environments (there are more graduates than formal jobs available).

Instead of coming together, Africa has become increasingly fractured by the decade: There have been many secession movements across the continent, with some actually being successful (to an extent): Sudan and South Sudan, Somalia and Somaliland. Others have failed but left a significant mark on their countries: Nigeria and Cameroon. Why we should band together like the European Union or the United States can be a whole post (or book) in itself, but I think this proverb will suffice: “If you want to go fast, go alone. If you want to go far, go together.”

To innovate, there needs to be greater emphasis on R&D. Africa’s R&D spending as a whole is well below the global average: 0.42% spending on their GDP vs 1.7%. To illustrate how jarring this is, if you look at the top 10* African countries in terms of total R&D spending (approximately 13.87 billion USD), it barely amounts to HALF of Apple’s total spending (26.25 billion USD). As the world continuously evolves in this technology boom, there needs to be an increased focus on investment in R&D so we can innovate.

If we want Africans to prosper, we need to work toward greater economic freedom in Africa.

Entrepreneurship and the free market in Africa are stifled and inaccessible for most due to the lack of infrastructure, extreme bureaucracy, corruption, lack of human capital, etc. The list goes on and on. Although there are opportunities for the cunning (essentially exploitation: corruption is a benefit if you know how to use it; informal institutions = low expenses, etc.), Africa won’t grow if entrepreneurship and the free market aren’t embedded in the culture and mindset of people. Without a widespread shift towards productive labour and value creation, spurred by a robust entrepreneurial culture, Africa's path to prosperity remains arduous.

I believe Africa already has the potential for entrepreneurship and a free market, but it is currently limited in scale and not yet ingrained in our collective mindset/culture. A shining example of this potential is the emergence of fintechs, such as M-PESA in Kenya, which revolutionized mobile money and banking, enabling millions to access financial services for the first time. Similarly, Flutterwave and Paystack, born out of Nigeria, have significantly lowered barriers for African businesses to engage in global commerce, showcasing the transformative power of African innovation in the financial sector.

Beyond the fintech revolution, agriculture technology startups like Twiga Foods are redefining supply chains by connecting Kenyan farmers directly to retailers, eliminating middlemen, and improving profits and efficiency. This model not only boosts local economies but also serves as a blueprint for modernizing agriculture across the continent.

Moreover, the African Continental Free Trade Area (AfCFTA) represents a landmark achievement, uniting 43 African countries in what has become the largest free-trade area in the world, even surpassing the World Trade Organization. AfCFTA is a testament to Africa's commitment to creating a unified market, promising to enhance trade, spur growth, and ignite entrepreneurship on a scale previously unimagined. It embodies the continent's collective ambition to forge a prosperous future through increased economic integration and cooperation.

These examples underscore the dynamic entrepreneurial spirit and market potential within Africa. They highlight what is possible when innovative minds meet supportive policies and hint at the untapped reservoir of opportunities waiting to be harnessed across the continent. As these successes become more widespread, they will undoubtedly play a pivotal role in embedding the principles of entrepreneurship and free market economics into the African mindset, driving us toward a future marked by prosperity and innovation.

I've been thinking in the last couple of weeks: how many African billionaires will there be in the future? As of 2024, Africa is home to 20 billionaires with a combined worth of $82.4 billion. Globally, there are 2,640 billionaires. This juxtaposition raises intriguing questions about the future growth of African billionaires. Given the dynamic economic landscape and the potential for entrepreneurship and innovation in Africa, the number of African billionaires could increase as the continent continues to develop and integrate into the global economy.

Conclusions

For the Individual:

In order to achieve personal and financial growth, it is important to critically assess the advice of successful individuals. While mentors and role models offer valuable insights, their strategies may not always apply to your current context or stage of your journey. Therefore, educating yourself, seeking diverse perspectives, and carefully customize advice to fit your specific circumstances is important. Begin by setting clear and realistic goals, then gradually develop the habits and skills necessary to achieve them. Embrace failure as an opportunity to learn and remain adaptable, understanding that the path to success is iterative and unique to each person.

For Africa:

Similarly, Africa's path to economic freedom and prosperity cannot simply mirror the strategies of currently developed nations. Instead, the continent must forge its path by addressing its unique challenges and leveraging its vast potential. This begins with a concerted effort to invest in education that is relevant to Africa's needs, fostering innovation through increased R&D spending, and building infrastructure that supports entrepreneurship and market access. Collective action and unity are paramount, drawing on the proverb, "If you want to go fast, go alone. If you want to go far, go together." Africa can catalyze sustainable growth through regional cooperation, such as the AfCFTA and the various geopolitical/economic blocs (ECOWAS, SADC, etc.), and a commitment to creating an entrepreneurial culture. Advocacy for policy reforms that reduce bureaucracy, fight corruption, and encourage investment will also be key in creating an enabling environment for success.

In both individual pursuits and Africa's collective journey, the principle remains clear: success is not merely about emulating the final outcomes of those who've succeeded before us but understanding and adapting the foundational principles and hard work that fueled their ascent. By embracing this nuanced approach, we can navigate the complexities of personal finance and development, charting courses that are both innovative and deeply rooted in our unique contexts.

*I calculated this figure manually and only went up to the top 10. But I’d wager that even the top 25 African countries wouldn’t reach Apple’s spending on R&D!

Very important points in here, Malik. I feel that too many of us miss these. Stories of the successful are at best an inspiration, not a instructional map.

Many of the developed countries employed very protectionist policies while growing, opening up much later. Some still do, just look at how Europe shields its agriculture from imports. South Korea remained deeply corrupt (during its developing years) yet still managed to advance fast, largely because of sustained FDI, mostly from the US.

I'm not saying that we should be protectionist or not focus on corruption, of course, just reiterating the point that policy should be reflective of the needs of a nation, region, or continent.

Thanks for a nice article, once again.

Great post Malik. Its always interesting to hear your thoughts on the future of Africa, a region that will certainly grow in importance in the world!