Malik Djinadou

In the heart of West Africa lies a city pulsating with life, fueled by the world’s love for chocolate. Ivory Coast, contributing a staggering 10% of cocoa in every chocolate bar worldwide, is home to Abidjan, a city draped in tropical allure and rich cultural tapestry. Imagine a city thousands of miles away, where French flair meets North American resilience - welcome to Montreal. In this captivating journey, we explore the intriguing possibility of redefining your living standards without altering your income. What if a change in longitude and latitude could unlock a world of financial freedom and cultural enrichment? This is the intriguing crossroads at which many contemporary professionals stand today.

In this installment of our cost of living comparison series, we delve into the financial implications of moving from Montreal to Abidjan. As you look through this piece, please reflect on your circumstances and ponder the potentialities. Could a geographical shift be the solution to enhancing your fiscal well-being and overall life satisfaction? Our focus will be strictly on the financial implications of such a move, dissecting the cost of living, taxation, and potential for savings, aiming to provide a comprehensive and clear comparison to aid in your decision-making process.

Didier’s Dilemma

Meet Didier, a finance consultant in the vibrant city of Montreal and a proud first-generation Canadian. In his late 20s, Didier has carved out a space for himself in the financial world, but the high cost of living in the city is starting to make him rethink his choices. "At this rate, I'll have to take out a loan to afford my morning omelette," he jokes, reflecting on the rising cost of eggs and living expenses. Paying $1,200 a month for a small apartment and feeling the financial pinch at every turn, Didier is on the lookout for a change.

Dreaming of financial freedom and a chance to make the most of his earnings, Didier sets his sights on Abidjan, Côte d'Ivoire, the city of his grandparents. This city, with its growing economy and more affordable lifestyle, seems like the perfect antidote to his financial woes: tropical weather year round, and most importantly: more affordable. Didier dives into the numbers and discovers that consumer prices in Abidjan are 30% lower than in Montreal, and when rent is factored in, the cost of living drops by an impressive 33.9%. The thought of paying around $665 for a 1-bedroom apartment in the city centre of Abidjan, as opposed to his current sky-high rent, brings a smile to his face.

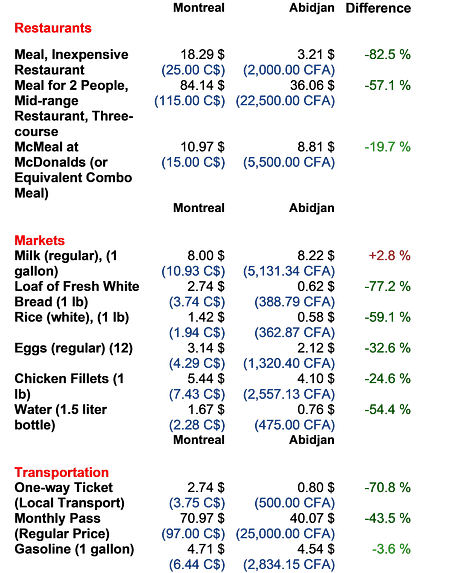

Dining out and grocery shopping are all significantly cheaper in Abidjan. Didier can’t help but imagine the life he could lead with these savings. If he were to work remotely for a Canadian company from Abidjan, he could potentially save a substantial amount each year, inching closer to his financial goals without sacrificing his career aspirations.

Of course, Didier knows that this big move would come with trade-offs. Some amenities and services he's grown accustomed to in Montreal might be less readily available in Abidjan. But as a finance consultant, Didier is familiar with weighing pros and cons, and the potential financial benefits are too significant to ignore.

With the allure of Abidjan growing stronger each day, Didier is seriously considering this bold move. The reduction in living costs could translate into a more spacious apartment, perhaps even with a view of the ocean, for a fraction of his current rent in Montreal. Dining out, a luxury in Montreal could become a more regular occurrence, sampling the rich Ivorian cuisine without breaking the bank. Groceries, including fresh local produce, would be more affordable, enabling a healthier and more varied diet. The savings could also facilitate travel. This could be the financial game changer he has been looking for.

What are your thoughts on Didier’s deliberations? Could a strategic relocation be the secret ingredient to achieving a more balanced and financially secure life?

Some NumbersComparison

Summary

Consumer Prices in Abidjan are 30.0% lower than in Montreal (without rent).

Consumer Prices in Abidjan are 33.9% lower than in Montreal (Including Rent).

Rent Prices in Abidjan are 43.1% lower than in Montreal.

Restaurant Prices in Abidjan are 61.9% lower than in Montreal.

Groceries Prices in Abidjan are 40.5% lower than in Montreal.

Health Care and Quality of Life

An essential aspect of choosing a city to live in is the quality of healthcare and its overall quality of life. Montreal, with its well-established healthcare system, scores 62.85 on the Numbeo Health Care Index. The index ranges from 0 to 100, where 100 is the best possible. Abidjan, while vibrant and bustling, scores lower on the Health Care Index at 37.35. For Didier, this presents a crucial consideration, as the quality of healthcare services is paramount.

Regarding the Quality of Life Index, Montreal stands tall at 153.77, offering its residents a high standard of living. The city scores high in safety, healthcare, and climate, ensuring a comfortable and secure environment for its inhabitants. Abidjan, with a Quality of Life Index of 7.01, tells a different story. The city is teeming with energy and potential, but it also faces challenges in terms of safety, healthcare, and pollution. The Cost of Living Index in Abidjan is lower at 45.20, offering financial relief, whereas Montreal is 64.26, which is moderate.

The significant disparities in living costs between Montreal and Abidjan can be traced back to a web of interconnected factors, including the stages of economic development, the balance of supply and demand, the state of infrastructure, government policies, and prevailing cultural norms.

Montreal, nestled in one of the world's most developed and prosperous nations, boasts higher wages and, consequently, higher costs for goods and services. The city's strong economy, coupled with abundant employment opportunities and a high standard of living, makes it an attractive destination, driving demand for housing and services. This high demand, paired with limited availability, inevitably leads to increased living costs.

Conversely, Abidjan, situated in a region still on its developmental journey, presents a different economic landscape. The city is vibrant and growing, yet the living costs remain generally lower than in more developed parts of the world. Abidjan is becoming an increasingly attractive destination, but it has yet to experience the same level of demand pressure as seen in Montreal.

While Montreal's established infrastructure and robust public services offer convenience and efficiency, they contribute to the city's higher living costs. In Abidjan, the ongoing development of infrastructure is a double-edged sword; it signals progress and potential, but it also means that some amenities and services may need to be more readily available or as reliable as in more developed cities.

The cost of living disparities between Montreal and Abidjan result from a complex interplay of economic, social, and cultural factors. Understanding these nuances is crucial for anyone considering a move between these two diverse cities, as it provides insight into not just the financial implications but also the lifestyle adjustments that such a move would entail.

Talking about Taxes

Taxation is another factor impacting disposable income and cost of living. Montreal has a high tax burden, including a provincial income tax that ranges from 15% to 25.75%, depending on income level, and a federal income tax that ranges from 15% to 33%, depending on income level. There is also a goods and services tax (GST) of 5% and a Quebec sales tax (QST) of 9.975% on most goods and services. Hypothetically, a tech firm with $30 billion in sales and 10,000 local staff would pay more than $2 billion in taxes in Montreal. Additionally, the imposition of a 5% Goods and Services Tax (GST) and a 9.975% Quebec Sales Tax (QST) on most goods and services further amplifies the financial commitments of both consumers and businesses.

In contrast, Abidjan takes a more straightforward tax approach with fewer business levies, which means that the tax rate is lower for most taxpayers, regardless of their income or profit. Firms pay a corporate income tax of 25%, subject to a minimum tax, and a value-added tax (VAT) of 18% on most goods and services. Additionally, a property tax varies from 1.5% to 15% depending on the use of the land.

While the lower taxes in Abidjan allow residents to keep more of their earnings, the reduced revenues also limit the city’s ability to provide the same level of infrastructure and public services as Montreal. But for those focused on maximizing take-home pay, Abidjan’s tax structure is advantageous. The trade-off is weighing the quality of life factors enabled by tax revenues against individual income growth potential.

Opportunities

Agriculture and Agribusiness: Côte d'Ivoire stands out globally as a powerhouse in agriculture, particularly through its world leading cocoa and cashew production. Agriculture alone accounts for 20% of the nation’s GDP and employs almost half the workforce. Thus, for professionals in agribusiness, Abidjan offers a fertile ground for innovation and investment.

Extractive Industry: The extractive industry, spanning mining, oil, and gas sectors, is gradually garnering more attention and investment, signalling a diversification in the economy. The discovery of oil and gas fields, such as the Baleine, is a testament to this growth, attracting foreign direct investment and contributing to 39.2% of it. This sector’s expansion hints at a promising future for professionals and investors alike.

Additionally, if you are especially keen on opportunities in Ivory Coast, I recommend checking out Jean Yves @ L’investisseur Africain, an entrepreneur providing opportunities to people who want to invest in various opportunities in Ivory Coast.

Is The Grass Always Greener?

In conclusion, this analysis has delved deep into the financial intricacies of life in Montreal and Abidjan, offering a detailed comparison through the lens of potential savings, living costs, and taxation. The potential benefits of relocating to Abidjan are clear: substantial cost savings, a lower cost of living, and the opportunity to experience a vibrant, growing city. However, it is crucial also to consider the potential drawbacks, including the challenges of adapting to a new culture, potential language barriers, and navigating a different economic landscape. For those contemplating such a move, it is imperative to conduct thorough research, seek advice from expatriates who have made similar moves, and consider a short-term stay in Abidjan to firsthand experience the city before making a final decision. Ultimately, the decision to relocate should be a well-informed one, weighing the financial benefits against the potential challenges and ensuring that the grass is indeed greener on the other side.