China is done.

OK, OK. That might be a little over the top. Perhaps we could say that China's time as the world's greatest growth darling is done. So, if you want access to emerging market stocks with blistering "China-like" economic growth, African stocks are the last great investing frontier.

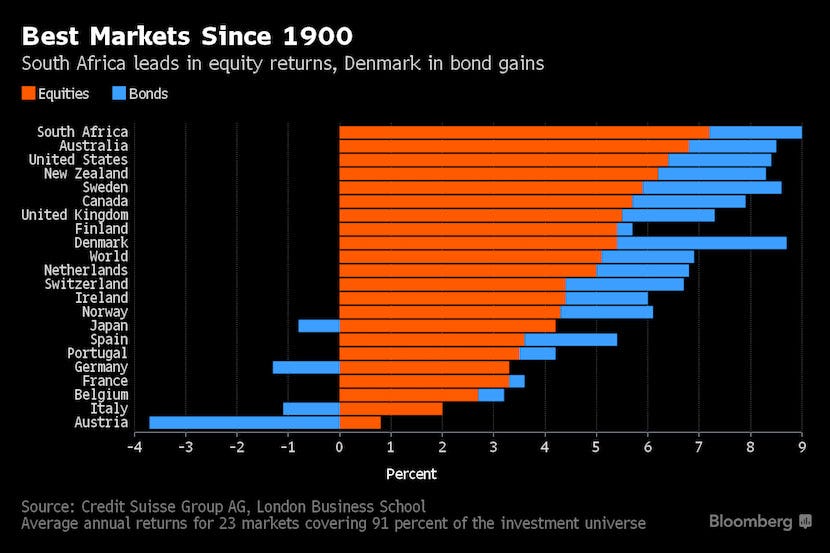

Equities have consistently been the best wealth builders in modern history due to their potential for high returns, especially over the long term. They offer investors a share in companies' profits, which can grow significantly over time. Historical data shows that equities easily outperform other asset classes regarding long-term growth, such as bonds, real estate, and cash. This is due to the power of compounding, where reinvested dividends and earnings contribute to exponential growth.

Brief History of Equity Markets in Africa

Equity markets in Africa have a rich history dating back to the early 20th century. The Johannesburg Stock Exchange (JSE), founded in 1887, is Africa's oldest and largest stock exchange. Following the independence movements of the mid-20th century, several other countries established their exchanges, including Nigeria (1960), Kenya (1954), and Morocco (1929). These markets have evolved significantly, integrating modern trading systems and regulations to enhance transparency and attract investment.

The Challenges of African Stock Markets

African stock markets face several challenges that have historically deterred both local and foreign investors. Understanding these challenges is crucial for grasping the full potential and risks of investing in these markets.

Currency Volatility:

Currency instability is a significant issue. For instance, in the first half of 2024, Nigeria’s naira has weakened by 40% since the beginning of the year, causing substantial losses for foreign investors despite strong local market performance (33.3%). Similarly, the Egyptian pound's steep decline against the US dollar resulted in a 26% loss for international investors despite local stock index gains (17%).

Liquidity Issues:

African stock markets often suffer from low liquidity, making it difficult for investors to enter and exit positions without affecting the market price. This low liquidity is partly due to the small number of participants and high numbers of institutional investors, such as pension funds and insurance companies dominating trading activities. While these institutions provide stability, their large trades can cause significant price swings due to the lack of counterbalancing trades from retail investors.

Regulatory Challenges:

Regulatory environments in many African countries can be unpredictable. South Africa’s JSE has a well-developed regulatory framework. In contrast, some African markets struggle with less developed regulatory frameworks. These markets often face challenges such as inconsistent regulation enforcement, lack of transparency, and limited investor protection.

When There Are Challenges, There Is Opportunity

High Risk, High Reward

Despite these challenges, African stock markets present unique opportunities for investors willing to navigate the risks. The potential for high returns, driven by the continent’s economic growth, natural resource wealth, demographic trends, and increasing integration into the global economy, makes these markets particularly attractive.

Untapped Potential:

Africa's economic growth rates are among the highest in the world. Africa is expected to remain the second-fastest-growing region after Asia. The continent’s real GDP growth is projected to average 3.8% in 2024 and 4.2% in 2025, outpacing the global averages of 2.9% and 3.2%, respectively.

Historical Performance:

Many African stock markets have shown strong historical performance despite recent currency challenges. The Nairobi Securities Exchange All-Share Index returned over 45% for dollar investors in 2024 after a difficult 2023. The Johannesburg Stock Exchange has also delivered robust long-term returns, driven by South Africa's diversified economy (over 12% annually since 2009.)

Local Investor Advantage:

Local investors, who do not face currency exchange risks, have reaped significant benefits. For example, Nigeria's NGX All Share Index soared 33.3% in naira terms since the start of 2024. Such gains highlight the potential for wealth accumulation through equities, which remain underutilized and can help locals endure their currency woes and inflation.

Unique Regional Initiatives:

Unlike the currency-driven losses in some African markets, the BRVM, a regional stock exchange for eight West African countries, delivers solid returns in both local and foreign currencies. Through July 12th, the BRVM Composite index has risen 8.18% in local currency terms, 6.74% in US dollars, and 7.97% in euros, demonstrating the benefits of a stable currency environment.

This stability is due to the CFA franc, used by BRVM member countries, which is pegged to the euro at a fixed rate. This peg provides stability and predictability, unlike many other African currencies. The eight countries served by the BRVM—Benin, Burkina Faso, Côte d’Ivoire, Guinea-Bissau, Mali, Niger, Senegal, and Togo—are all members of the West African Economic and Monetary Union (WAEMU), using the West African CFA franc since 1999.

The minimal gap between local and foreign currency returns highlights the value of currency stability. This makes the BRVM attractive for foreign investors seeking exposure to African equities without significant currency risk.

However, the CFA franc peg is controversial, with critics arguing it limits monetary policy flexibility and increases dependence on France. Despite this, the BRVM offers a compelling alternative for investors seeking a balance between high-growth, high-risk markets and the stability of developed economies.

Emerging Sectors:

Technology: The rise of tech hubs in countries like Kenya (often referred to as “Silicon Savannah”) has attracted significant investment and innovation.

Renewable Energy: More countries are investing in their abundant natural resources to create energy necessary for self-sufficiency. This increases production and provides value to the rest of the world.

Fintech: Mobile banking and payment solutions, where Africa is a global leader, have revolutionized financial services, increasing financial inclusion and economic activity.

Favourable Demographics

The growth of the middle class in many African countries leads to increased domestic consumption and investment. Additionally, Africa is the youngest region in the world, with around 40% of its population aged 15 years and younger, compared to a global average of 25%. This youthful demographic presents a significant opportunity for economic growth, as a larger working-age population can drive innovation and productivity. This demographic shift results in higher demand for goods and services, which benefits companies listed on the stock market. Key impacts include:

Increased Spending Power: A growing middle class means more disposable income, leading to higher consumption of consumer goods, real estate, and services.

Investment in Education and Health: As incomes rise, there is greater investment in education and healthcare, which boosts sectors like pharmaceuticals, private education, and insurance.

Entrepreneurship: A more affluent middle class often leads to a rise in entrepreneurship, with more people starting businesses that can eventually list on the stock market.

Drawing Parallels: Lessons from History

Africa's current stage of development and market potential can be likened to the early days of emerging markets in Asia and Latin America. For example, in the late 20th century, countries like China, India, and Brazil faced similar economic instability, regulatory hurdles, and currency volatility challenges. However, those who invested early in these markets reaped significant rewards as these economies stabilized and grew:

Asia:

In the 1980s and 1990s, Asian markets like China and India were considered high-risk due to political instability, poor infrastructure, and regulatory unpredictability. And yet:

The Shanghai Stock Exchange Composite Index (SSE) has grown substantially from 1990 to 2020, from around 100 points to over 3,000 points.

Likewise, the BSE Sensex, India’s benchmark index, has shown remarkable growth. From 1990 to 2020, the Sensex increased from about 1,000 to over 40,000 points.

Latin America:

Similarly, Latin American markets faced significant volatility and economic challenges in the 1990s:

Brazil: The Bovespa Index (IBOVESPA) has seen impressive growth. From 1990 to 2020, it increased from around 1,000 points to over 100,000 points.

Mexico: The IPC (Índice de Precios y Cotizaciones) has also grown significantly. From 1990 to 2020, it rose from about 800 points to over 40,000 points.

Today, they are among the fastest-growing economies globally, delivering substantial returns to early investors.

Investing in African Markets: Buy Low, Sell High

Just like the previous emerging markets, the principle of "Buy Low, Sell High" applies profoundly to African markets. Given the current undervaluation and the potential for high returns, investors can capitalize on the growth trajectory of these markets.

The Bigger Picture

Investing in African stock markets involves navigating a landscape of risks and immense opportunities. Currency volatility, liquidity issues, and regulatory challenges are real concerns. However, these very challenges create the perfect storm for high-reward opportunities.

African economies are among the fastest-growing globally, with sectors like technology, renewable energy, and fintech leading the charge. Historical performance shows that long-term investors have reaped significant rewards despite short-term fluctuations. Local investors benefit from a lack of currency exchange risks, while regional initiatives like the BRVM offer a more stable environment for foreign investors.

Drawing parallels to the early days of Asian and Latin American markets, Africa stands at a similar crossroads. The principle of "buy low, sell high" is particularly potent here. The potential for exponential growth is unparalleled as the continent continues to develop.

Diversifying your investment portfolio by including African equities adheres to sound investment principles and positions you to capitalize on one of the last great frontiers of economic growth. The key is approaching these markets with a long-term perspective, leveraging local advantages and mitigating risks through informed strategies.

The time is ripe: As an African and an investor, embarking on this frontier could be the gateway to unprecedented wealth accumulation and financial independence.

A great post Malik, and thanks to the link to my work on self-sufficiency.

Very interesting that Morocco decided to establish their stock exchange in 1929, with the impacts of the Great Depression raging in many countries! I'm in agreement that Africa certainly has potential to emerge as a great investment opportunity over the coming decades. Do you find yourself invested in any Africa opportunities?

Herh!!!! Are you serious you did not know about South African stock market and capital markets? South Africa has always been one of the major financial sectors investment banks have trading operations. Around the world global books go from Asia (Singapore/ Hong Kong) to South Africa to London to US and its been so since 90s.

I'm surprised you're surprised