Most of us dream of becoming millionaires, but how many ll it's within reach? Imagine achieving this on a high school teacher's salary. This is not just a hypothetical scenario but the real-life story of Andrew Hallam, vividly captured in Millionaire Teacher. His journey from an educator to a debt-free millionaire defies conventional financial wisdom and offers hope to those daunted by the complexities of wealth accumulation.

Andrew Hallam's book breaks down the barriers of personal finance into nine straightforward and accessible guidelines. Today, we will delve into and review some of these transformative principles. Hallam's story isn't just about financial success; it's a compelling narrative showing that the path to wealth is more achievable than many of us think, even for those starting with modest means.

Think and Behave Like A Millionaire If You Want To Become One

The first principle Hallam introduces is the mindset shift towards intelligent spending. He emphasizes distinguishing between essential purchases and unnecessary extravagances, thus allowing for enhanced savings and investment opportunities. This principle is the cornerstone of Hallam's path to financial freedom.

Andrew supports this principle with a helpful example: most homes in the US valued at $1 million or more are not owned by millionaires. Instead, they are owned by people who are not millionaires. Surprisingly, 90% of those who meet the criteria to be a millionaire live in homes valued at less than $1 million. The same principles apply to cars as well. It’s also worth noting that primary residence and transportation are among the top three expenses of households on average. Therefore, it's important to remember that if you want to become a millionaire, you should spend like one.

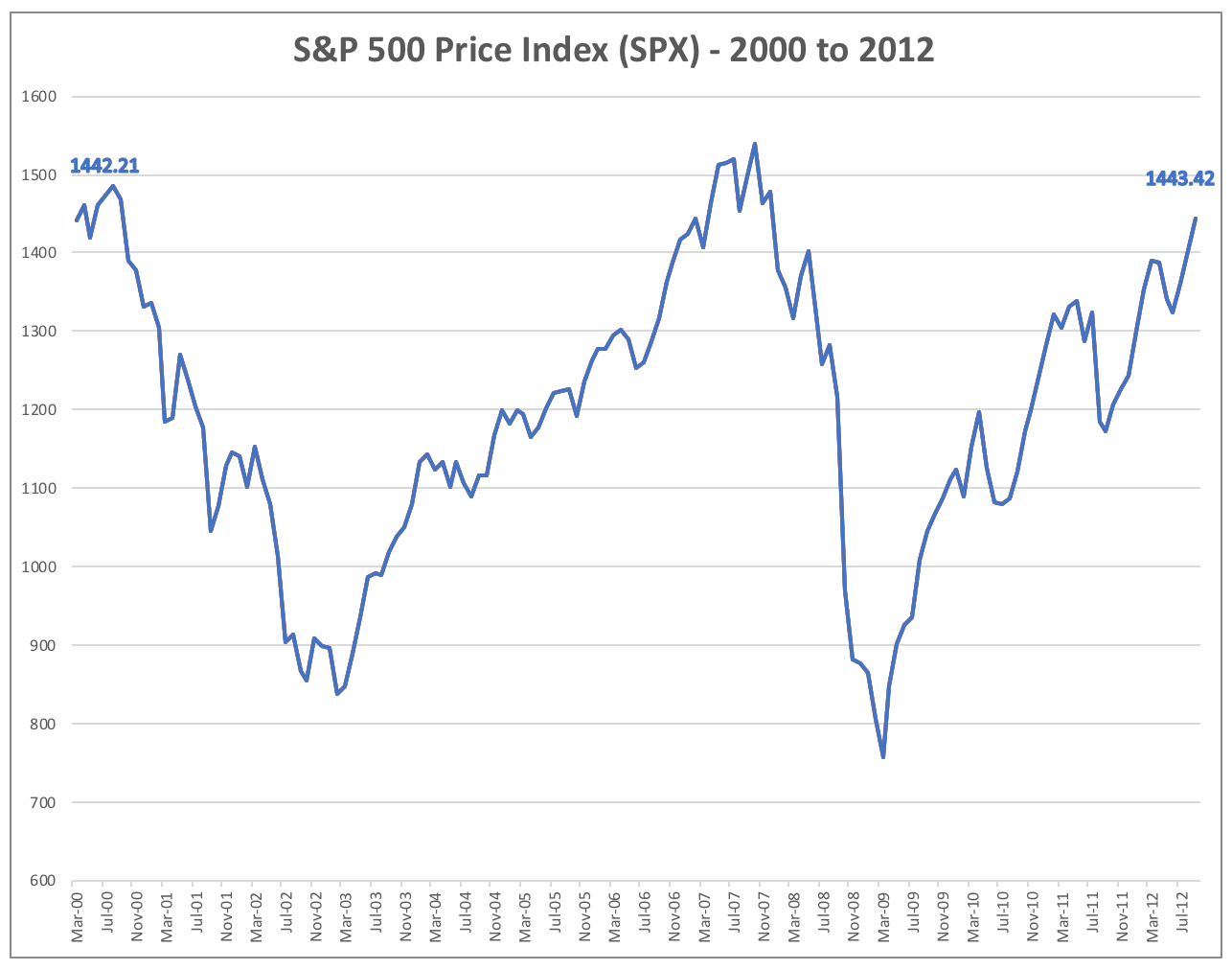

Don’t Wait To Invest, Invest And Wait

Andrew emphasizes that time is your greatest ally. His approach to investing mirrors his discipline as a long-distance runner. He understands that similar principles apply to the journey to financial wealth just as success in long-distance running requires consistent pacing and patience. Emphasizing time as your greatest ally, Andrew’s path to becoming a millionaire is marked by this same endurance and long-term view. Beginning his investment journey at 19, he harnessed the power of consistency and compounding interest to achieve millionaire status in merely 20 years. Adding to this, the most amazing of this feat, in my opinion, is that Andrew accomplished this during the 2000s, aka “The Lost Decade” (for the S&P 500 at least). This era was fraught with financial challenges, making investing in the 2000s a very rough time for investors. The decade began with the dot com bubble and ended with the 2008 financial crisis, which featured stock market collapses. And yet, Andrew emerged a millionaire due to his consistent investing over time, not timing the market, and taking advantage of uber-low prices in the market, as he knew that markets go up over time and that crashes actually mean bargains. This understanding of time allowed him to reach his goals faster.

Just as a long-distance runner focuses on the steady accumulation of miles rather than the fleeting sprint to accomplish their goal, Andrew’s story illustrates the importance of persistence and a long-term perspective in investing. The concept of compounding interest is simple yet powerful; the earlier you start investing, the more time your money has to grow: your earnings will earn more, creating a snowball effect that can lead to significant wealth accumulation. Therefore, it's essential to start investing as early as possible and remain consistent with your investment strategy, even during market downturns. By doing so, you can take advantage of the power of compounding interest and achieve your financial goals over time.

Andrew advises only investing after clearing high-interest debts, like credit card dues, as most returns you generate will not beat the interest on your high-interest debt.

How To Invest

Andrew’s approach is simple yet practical - allocate your investments into three parts: an index fund from your home country (or the American index), an international market index (excluding the aforementioned index), and a bond index fund. The bond allocation should roughly be your age or your age minus 10, adjusted for risk profile. Set a period (weekly, monthly, etc) where you consistently buy the index in these proportions. It will take a few minutes each year to rebalance your portfolio by simply selling parts of your investments that have overperformed and reinvesting them in the other parts. This diversified approach embodies the wisdom of not putting all your eggs in one basket.

I largely agree with Andrew's advice. The reality is that consistently beating the market is challenging for most, including professional investors on Wall Street. Opting for index funds — a collection of stocks mirroring the performance of a market — mitigates the risks inherent in single-stock investments and the often speculative nature of stock picking. While you might not capture the high returns of individual stocks, you’re also shielded from their potentially drastic losses.

Furthermore, Andrew argues that investing in index funds can save you tens of thousands, if not hundreds of thousands, of dollars over time. The alternative is trading individual stocks or paying someone else to do it for you, both of which rack up fees that add up over time. He heavily cautions against actively managed funds, which often come with high fees (advisor fee, expense ratio, taxes, sales commissions, operational costs and more) and do not guarantee better returns than an index.

Common Investment Mistakes

Many people struggle with psychological barriers when it comes to managing their finances. Fear Of Missing Out (FOMO) is one obstacle that can lead to poor investment decisions. While it is easy to become excited about potential opportunities and the prospect of making a quick profit, it is important to remember that the biggest threat to your financial well-being is often yourself. It is crucial to be aware of your own fear and greed when making investment decisions.

To be successful, it is important to learn how to control yourself and ride the ups and downs of the market. Key to this is consistency, discipline, and a long-term mindset. It is essential not to try to time the market. Attempting to time the market often results in people buying shares at a higher price on average. When share prices are low or seem to be going down, people are less willing to invest, yet when prices rise, people tend to buy more shares, driving prices up even further. However, this approach is not effective and can lead to significant financial losses.

FOMO can be observed in recent events, such as the GameStop fiasco and Altcoin pushes. Some individuals have made huge profits by acting quickly on opportunities, while most have suffered significant losses.

It is vital to resist the temptation to chase quick wins and stay the course with consistent investments. Andrew emphasizes this point and shares his experience of amassing wealth during the “Lost Decade” by buying even more shares when the market dipped. He understood that markets generally tend to go up over time, and the shares he bought at $10 would cost him $30 later. While it can be tempting to follow the crowd and capitalize on sudden market fluctuations, this approach is often unsustainable and can lead to significant financial losses. Instead, it is essential to remain focused on long-term investment goals and avoid making impulsive decisions based on short-term market trends.

How Can I Avoid These Mistakes?

It's tempting to invest our money in stocks promising high returns. However, financial advisor Andrew suggests we allocate no more than 10% of our portfolio to picking individual stocks. This small percentage should be seen as our "gambling/fun money," while the remaining 90% should be invested in a diversified basket of indexes.

When selecting individual companies, Andrew recommends following Warren Buffet's stock picking strategy of buying great companies only when their stock prices are low. This means that when the stock prices of great companies fall, it's actually a good thing. Additionally, it's important to hold on to these stocks forever, even if they experience some short-term losses.

Andrew stresses that even if this 10% allocation performs exceptionally well, we should never deviate from our diversified index investment plan in the long run. Remembering that a diversified portfolio will provide more stable returns in the long term is important.

So Can YOU Become a Millionaire?

As we close the pages of Andrew Hallam's "Millionaire Teacher," we’re left with more than just financial strategies; we’re imbued with a renewed sense of possibility. Hallam's journey from an English high school teacher to a millionaire at 39 years old is a testament to his financial acumen and a beacon of hope for anyone believing that wealth is beyond their grasp. His narrative is a compelling reminder that a select few do not hold the keys to financial freedom but are within reach of anyone willing to embrace patience, consistency, and a bit of strategic planning.

This narrative resonates profoundly with the mission of Diaspora Dollars. Our goal is to educate and empower our community toward financial independence, and Hallam's book perfectly encapsulates this ethos. His approach—centred on early investing, harnessing the power of compounding, and the importance of the journey itself—offers invaluable lessons for us all. Hallam's success story illustrates that, regardless of one's income level, disciplined financial management and strategic investment can lead to substantial wealth accumulation—a core principle championed by our platform.

But the implications of achieving financial independence extend far beyond personal gain. For the African diaspora, this journey of financial empowerment has the potential to impact Africa as a whole profoundly. As more individuals in the diaspora attain financial freedom, they're in a stronger position to invest back into the continent, whether through entrepreneurship, real estate, or supporting local economies. This not only fosters economic growth but also contributes to the development and prosperity of our ancestral lands. By taking control of our financial futures, we're not just securing our own wealth but also contributing to a brighter future for Africa.

So, as we chart our paths toward financial independence, let us do so with the knowledge that the journey may be long, but the destination is well within reach.

Why should I strive for Financial Independence (FI) in Africa?

Imagine awakening to the soft light of Saturday morning, the sound of laughter and the sweet aroma of breakfast wafting from the kitchen. Your partner and children, beaming with excitement, present a tray filled with locally-sourced tropical fruits, a fluffy omelette infused with indigenous herbs, and warm, flaky bread from the local bakery. Accompanyin…

*Data presented without sources is taken from Millionaire Teacher, where all of the primary data is available in the index

This was excellent - I'd never heard of Andrew Hallam, but I heard of a similar story of a janitor who left millions in his will.

There's something to be said about the "appearance" of wealth compared to actual wealth - one is often traded for the other!

I’d never heard the story of Andrew Hallam but I’ll certainly be taking a look now! Great principles included in this piece too. Patience is one of the hardest characteristics to maintain, but the rewards for playing the long game can grow to unimaginable levels. Great post Malik!